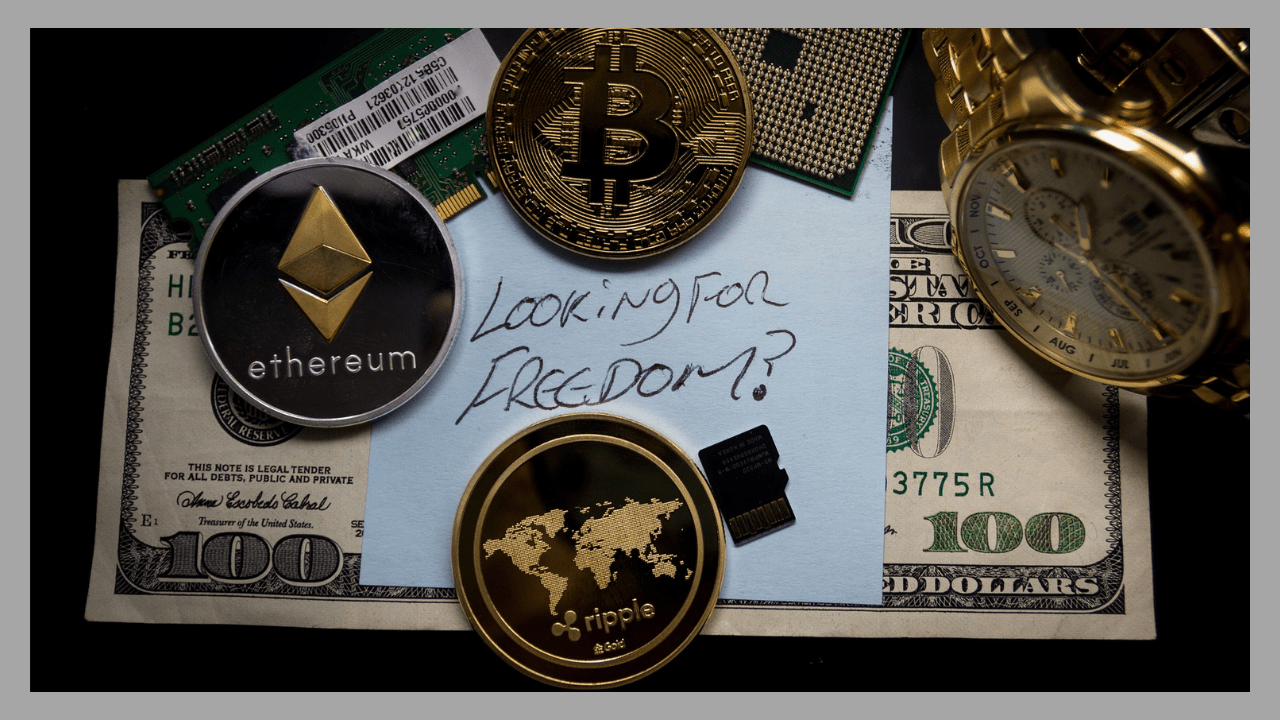

First and foremost, what is financial freedom? Financial Freedom means having planned financial management and allocation of assets, thus, giving a person a steady source of income for life.

Having financial freedom has nothing to do with one’s age or richness.

In fact, the moment a child learns the value of money, he should also be taught how to save.

Oftentimes, a person who struggles to save at a young age happens to adapt it even when he is older. This is much worst when he has a family of his own. And when that time comes, it will be too late.

Having a healthy perception that money is necessary to maintain an overall balance is key. As one earns money to achieve ends, it is, therefore, normal to earn money as long as one feels the ethical need to do so.

Luckily, our society is very much affected by social media right now. Being such, it serves as a reminder for us on how to save up for the future.

As this old saying still holds true up to now, health is indeed wealth. Taking care of yourself physically and psychologically assures you that you’ll be able to enjoy life to the fullest for a long time.

Schedule periodic checkups with your physician, exercise regularly, and maintain a healthy lifestyle.

Here are 7 practices that will aid in having financial freedom.

- Emergency Cash Reserves. Set aside a 3 to 6-month salary worth and have it readily available just in case you will be needing money pronto without incurring any penalty. Avoid using a credit card as much as possible.

- Risk Management. Insurance is the surest form of risk management. So, insure your car, home, and other significant assets. You may also consider life insurance to help compensate for lost income and repay debts in case of death. While finalizing your insurance option, always choose the insurance type that suits your requirements. Work out the necessary amount of coverage that is affordable for you.

- Estate Plan. The basic features of a personal estate plan are a will and a durable power of attorney as a provision for your financial freedom and medical care. In the case of larger estates, you may require, in addition, a living trust, marital trusts, and charitable trusts. Ensure that your assets are maintained and passed on to your future generations.

- Goal Setting. This is the coordinating framework for your financial plan. Whenever you receive an investment offer, always refer it to your overall financial goals. Ask yourself whether it is conducive or productive for, and suits, your goals. This commitment to your goals will help you remain focused in the long run.

- Investment. You need to have an asset allocation plan customized to meet your goals and to keep the element of risk within limits you find acceptable. Without this, your investments will be subject merely to the vagaries of the economy instead of being directed by your requirements.

- Retirement Plans. The income for supplementing your social security will derive from defined contribution plans and benefit plans. During your working life, try to make as much yearly contributions to these set plans as possible. These funds grow fast as a result of tax deferral.

- Tax Planning. This means taking advantage of all the possible tax deductions and tax-deferred plans that you are permitted by law, as well as using tax credits wherever you are eligible. A good tax plan may save you thousands of dollars in taxes.

If you feel that you can’t handle all this on your own, seek the services of a financial advisor or coach to devise a comprehensive plan according to your assets and needs.

You can learn practical ways on how to generate more income, thus leading to financial freedom here.

Very few percent of us actually know how to make a sound plan. Carefully consider the money management program as it would help you to be financially independent.

Any sort of financial freedom planning starts with proper money management. While building on your plan, make sure that you work on two important aspects. Firstly, addressing the issue of finding the fund to back your plans. And secondly, getting the money planned in such a way that your goals are met.

Please stick to a realistic money management plan.

Be aware of how you would achieve the funds.

Your goals should be specific.

Prioritize your goals so that the path becomes easier.

We are often misled by a few preconceived notions such as living for the moment. We fail to realize that there is a future that awaits us. That’s why it’s important to have an organized approach. Because if you fail, you will surely find yourself in some kind of trouble.